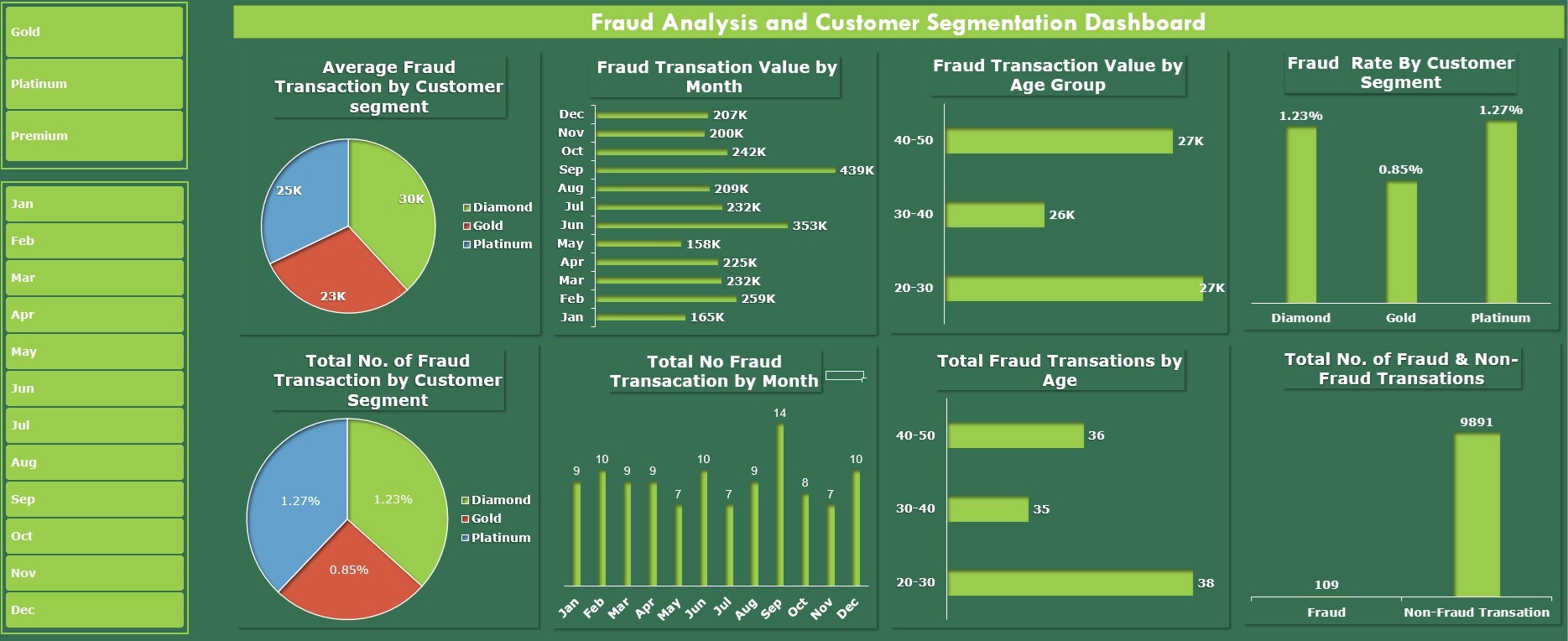

This project focuses on enhancing fraud analysis and customer segmentation strategies within a financial institution's credit card system. The following steps were taken to achieve this:

Data Utilization:

Comprehensive dataset including customer demographics, credit card details, transaction data, and fraud indicators.

Integrated Analysis System: Data cleaning and exploration techniques to ensure data accuracy and consistency.

Creation of relationships between datasets using Power Pivot.

Advanced Analysis: Identification of fraudulent transaction patterns.

Segmentation of customers based on behaviour and demographics.

Interactive Dashboard: Incorporation of PivotTables, PivotCharts, and slicers for data exploration.